Loans and credit can be useful instruments to assist you in reaching your professional and personal objectives. Mismanagement of them, however, might result in financial difficulties, credit score harm, and debt stress. You can keep control of your finances and use credit and loans responsibly by implementing wise tactics.

Here are a few essential tips for managing credit and loans wisely.

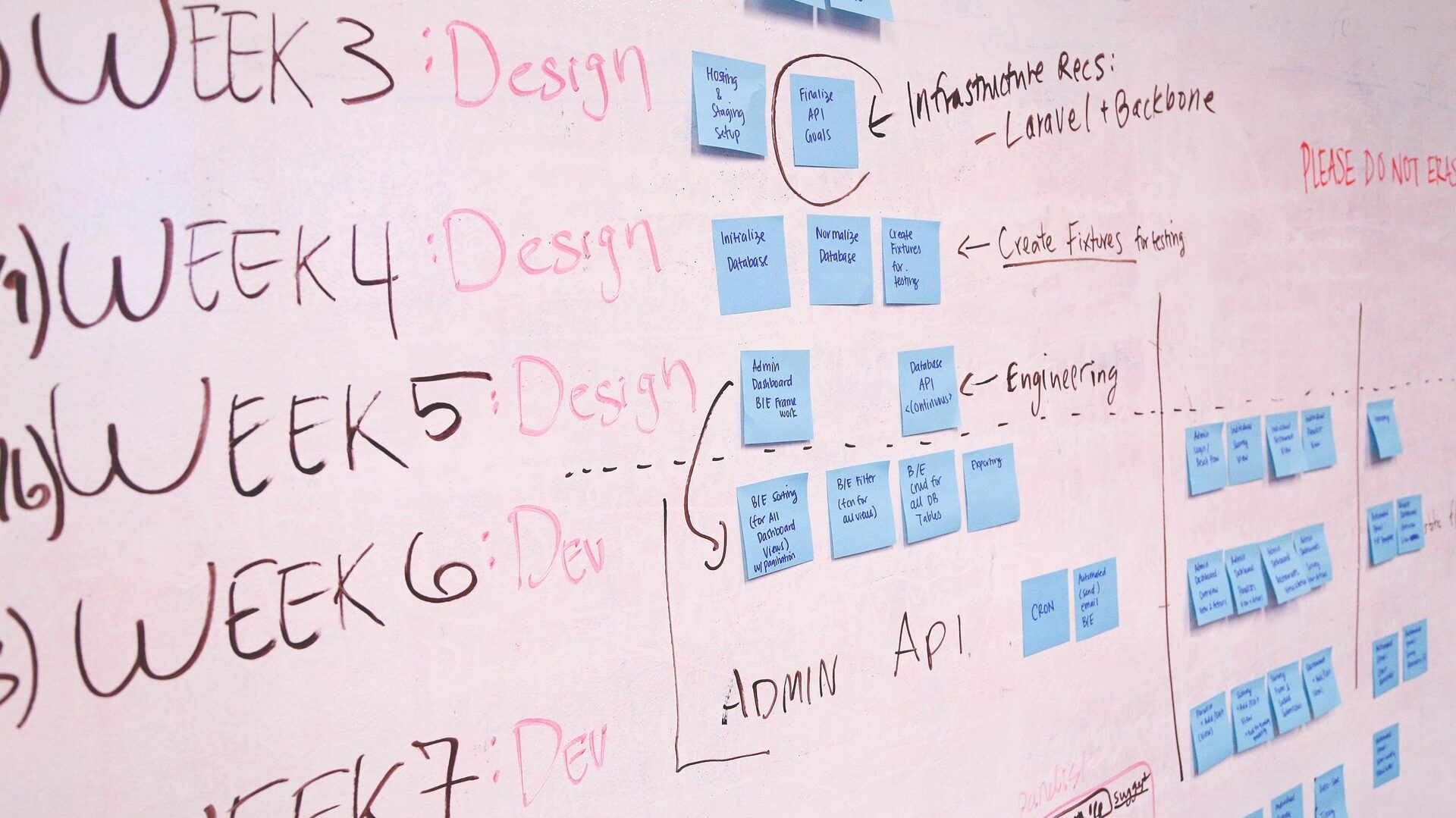

Understand What Your Loan Terms Are

Before borrowing, read and understand all the loan terms. Knowing what you’re agreeing to helps avoid surprises and enables better planning.

• Interest rate (fixed or variable)

• Repayment schedule

• Fees and penalties (late fees, prepayment penalties)

• Total cost of the loan over its term

Create a Realistic Budget

To find out how much you can afford to pay back each month stress-free, keep a close eye on your income and expenses.

• Add up all living expenses and debts.

• Make allowances for unforeseen costs and crises.

• If need, modify spending patterns to give loan repayments priority.

Make Payments on Time

Timely payments are critical to maintaining a healthy credit score and avoiding penalties.

• Set up automatic payments or reminders to avoid missing due dates.

• If you face financial difficulties, contact your lender proactively to discuss options.

Avoid Borrowing More Than Needed

Only borrow the amount necessary for your goal.

• Excess borrowing increases interest costs and repayment burden.

• Evaluate alternatives like saving up or cutting expenses before taking loans.

Keep Credit Utilization Low

For credit cards and revolving credit, maintain a low balance relative to your credit limit.

• Aim to use less than 30% of your available credit.

• High utilization can negatively affect your credit score and increase interest costs.

Pay More Than the Minimum

If possible, pay more than the minimum required monthly payment.

• This reduces the principal faster, lowering overall interest costs.

• Helps you become debt-free sooner.

Monitor Your Credit Report Regularly

Verify the accuracy of your credit reports at least once a year.

· Report mistakes or fraudulent activity right away.

• Monitoring keeps you up to date on the state of your credit.

Avoid Multiple Loan Applications at Once

Your credit score may suffer if you apply for numerous loans or credit cards quickly.

• Only apply to lenders you are really thinking about.

Applications should be spaced out to reduce impact.

Use Loans to Build Credit

Responsible use of credit and loans can improve your creditworthiness.

- Pay on time and keep balances low.

- Diversify credit types (e.g., installment loans and revolving credit) to strengthen your profile.

Seek Help When Needed

If managing debt becomes overwhelming, seek professional help and getting support early can prevent deeper financial trouble

• Credit counseling agencies

• Financial advisors

• Debt management programs