How to Increase Your Income & Save More

August 9, 2025

Saving Strategies for Financial Stability and Growth

August 9, 2025

What is Personal Finance? A Complete Guide

August 10, 2025

A Guide to Maximizing Savings and Financial Success

August 10, 2025

How to Achieve Financial Success by Avoiding Lifestyle Inflation

August 10, 2025

Wealth Accumulation: Building a Secure Future

August 10, 2025

Stock Market Insights: Navigating the World of Investing

August 9, 2025

Smart Strategies for Managing Unexpected Money

August 9, 2025

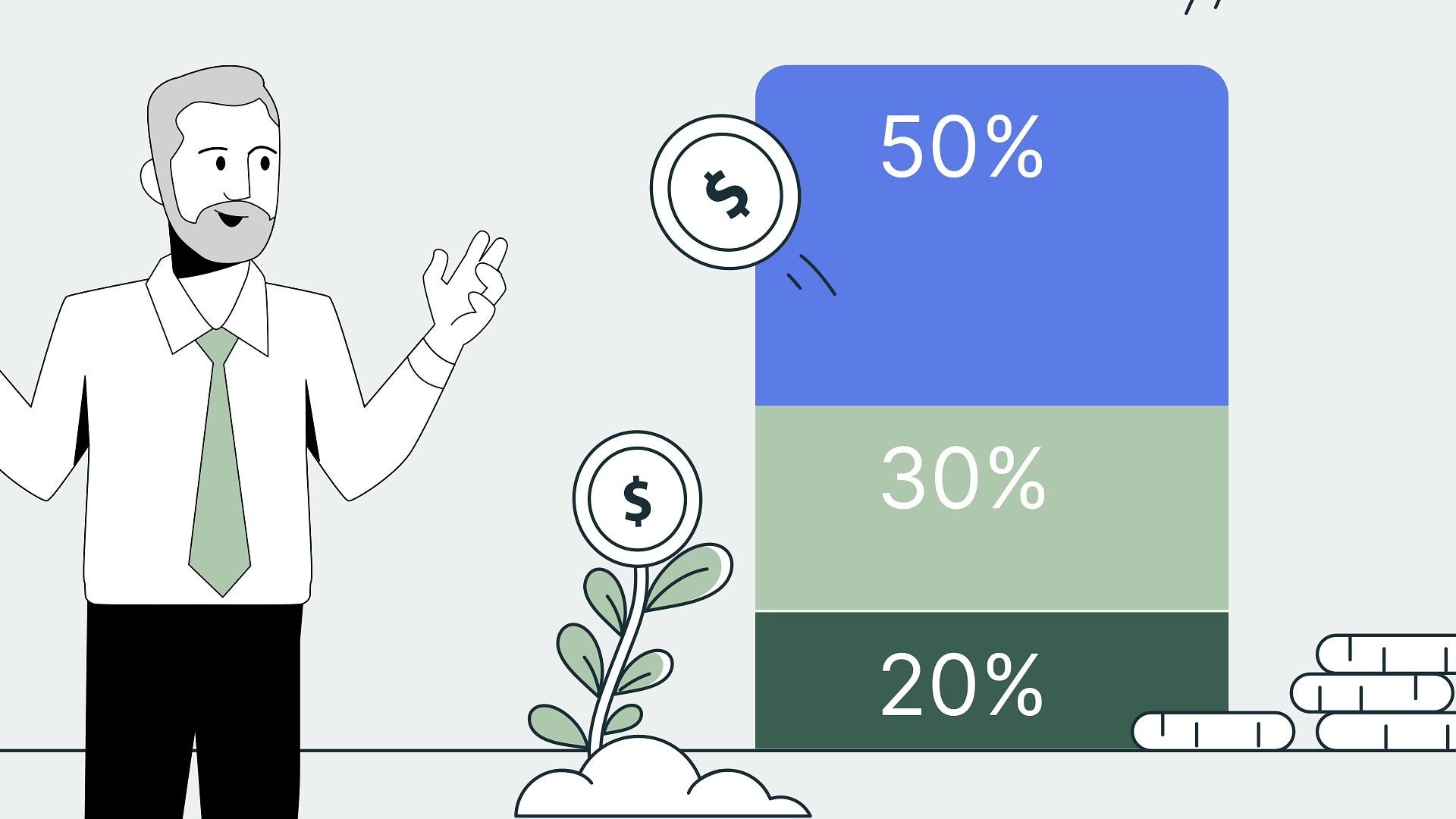

How to Follow the 50/30/20 Rule for Financial Success

August 9, 2025

Set Specific Savings Goals: The Key to Financial Success

August 9, 2025

Saving Strategies for Financial Stability and Growth

August 9, 2025

Pay Yourself First: The Smart Way to Automate Savings

August 9, 2025