For future security and financial stability, prudent money management is essential. The 50/30/20 rule is one of the best budgeting techniques; it’s a straightforward but effective way to balance needs, wants, and savings. This guideline relieves unnecessary worry while assisting you in maintaining regular savings, controlling spending, and reaching long-term financial objectives.

What is the 50/30/20 Rule?

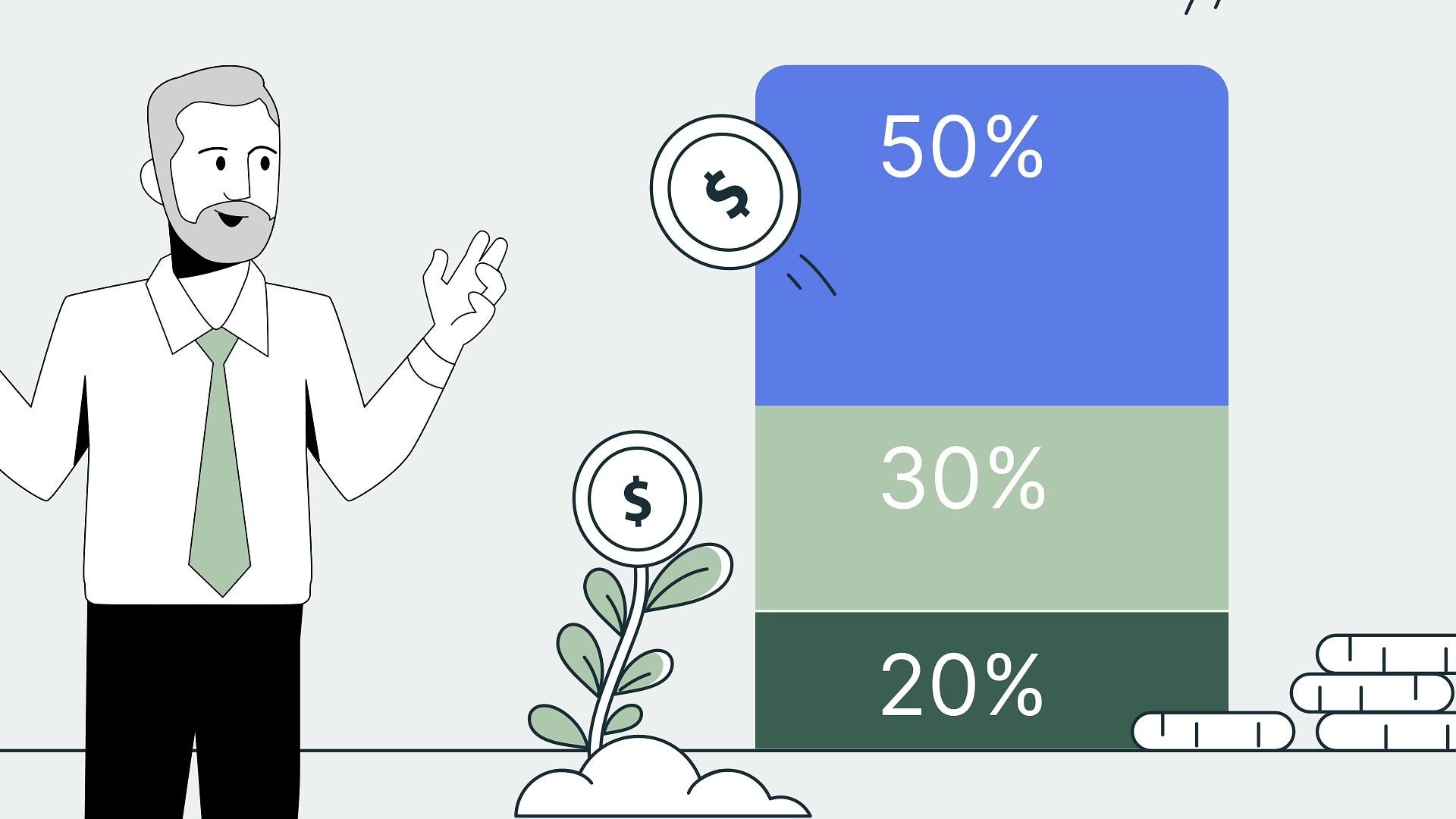

A budgeting guideline known as the 50/30/20 rule splits your post-tax income into three groups.

- 50% for Needs – Essential expenses like housing, food, and bills.

- 30% for Wants – Non-essential spending on entertainment, hobbies, and travel.

- 20% for Savings & Debt Repayment – Emergency fund, retirement savings, and paying off debts.

This method allows you freedom in spending while offering an organized approach to money management.

How to Apply the 50/30/20 Rule

1. Calculate Your After-Tax Income

- After taxes and deductions, find your total income.

- If you work for yourself, deduct taxes and business expenditures.

- Based on your net income, create a 50/30/20 breakdown.

2. Allocate 50% to Essential Needs

Needs are non-negotiable expenses required for survival and stability. These include:

- Rent or mortgage payments

- Utilities (electricity, water, internet)

- Groceries

- Transportation (gas, public transit, car payments)

- Insurance (health, home, car)

- Minimum debt payments

If your basic costs are more than half of your salary, think about cutting costs by taking public transit, getting more affordable insurance, or relocating to a less expensive area.

3. Assign 30% to Wants

Wants include non-essential items that enhance your lifestyle, such as:

- Dining out and entertainment

- Shopping for clothes and gadgets

- Hobbies and recreational activities

- Subscriptions (Netflix, Spotify, gym memberships)

- Travel and vacations

Wants are fun, but in order to avoid going over budget, it’s crucial to keep them to no more than 30% of your income.

4. Direct 20% to Savings and Debt Repayment

This category focuses on securing your financial future. It includes:

- Building an emergency fund (3-6 months’ worth of expenses)

- Contributing to retirement accounts (401(k), IRA, Roth IRA)

- Paying off high-interest debts (credit cards, personal loans)

- Investing in stocks, real estate, or other wealth-building assets

Prioritize paying off your debt as quickly as possible while keeping money set aside for emergencies.

Example Budget Breakdown

If your after-tax income is $4,000 per month, your budget would look like this:

- $2,000 (50%) for needs

- $1,200 (30%) for wants

- $800 (20%) for savings and debt repayment

This strategy guarantees that you’re taking care of the necessities, having fun, and safeguarding your future.

Benefits of the 50/30/20 Rule

✔ Easy to Implement – A simple method for all income levels. ✔ Balances Needs, Wants, and Savings – Ensures financial stability and flexibility. ✔ Encourages Financial Discipline – Helps you live within your means. ✔ Prepares You for Emergencies – Builds a safety net for unexpected expenses. ✔ Supports Long-Term Wealth Growth – Provides financial security for the future.